what is fit coming out of my paycheck

How much is coming out of my check. This means 62 of your wages are taken out of your paycheck and put toward the OASDIEE program.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

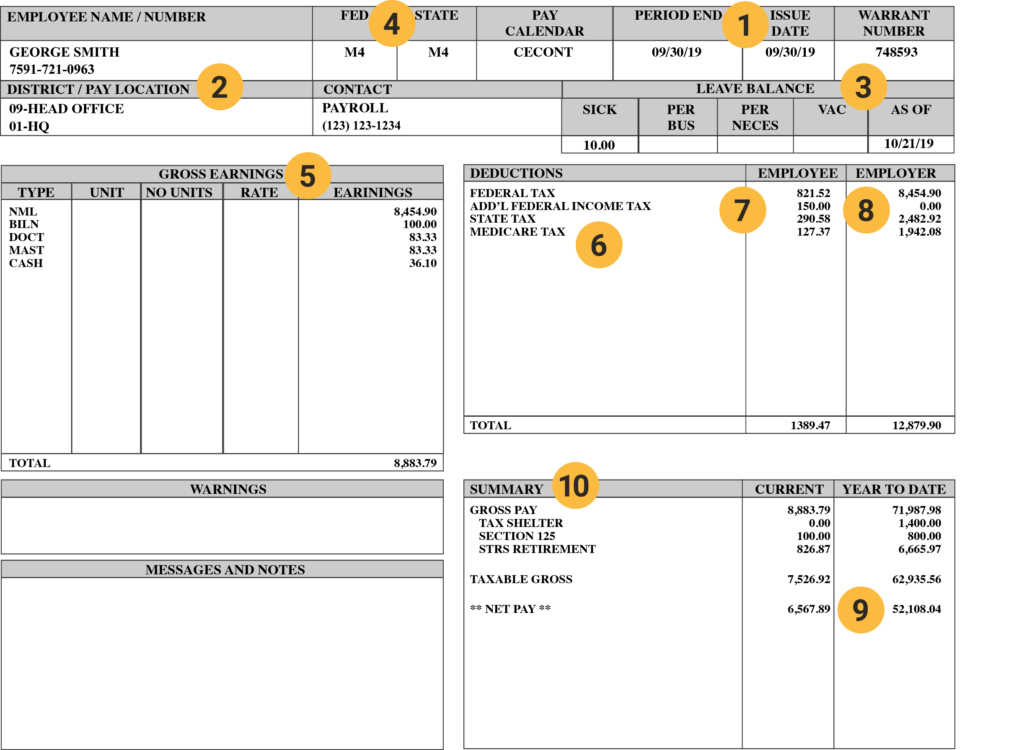

It is important to monitor the number of vacation and sick days.

. The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021. FIT Fed Income Tax SIT State Income Tax. Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck.

If you claim the maximum of 10 allowances youre instructing the employer not to withhold on 39000 of salary. Use an employees Form W-4 information filing status and pay frequency to figure out FIT withholding. Youll get a refund if you have too much withheld.

Fed OASDIEE 2021 Limit. These items go on your income tax return as payments against your income tax liability FICA would be Social Security and Medicare which are not. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

In the United States federal income tax is determined by the Internal Revenue Service. Federal Insurance Contributions Act. For the portion subject to withholding your employer uses a series of IRS tax tables to calculate the amount that should come out of your check each pay period.

It allows you to adjust your withholding upward or downward. Gross pay for each paycheck. If too much tax is being taken from your paycheck decrease the withholding on your W-4.

The standard deduction is 3900 per year For Year 2013. These accounts take pre-tax money so they also reduce your taxable income. You can have more withheld from your paycheck to cover you at tax time if you expect significant investment income or if you have other outside income thats not subject to withholding.

Make an additional or estimated tax payment to the IRS before the end of the year. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years. Federal Tax Amount.

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. This form covers any tax that you may owe to the Federal government come tax time. If too little is being taken increase the withheld amount.

The amounts taken out of your paycheck for social security and medicare are based on set rates. And is deducted from each paycheck. This can show the hours you have accrued or that may come on a separate statement.

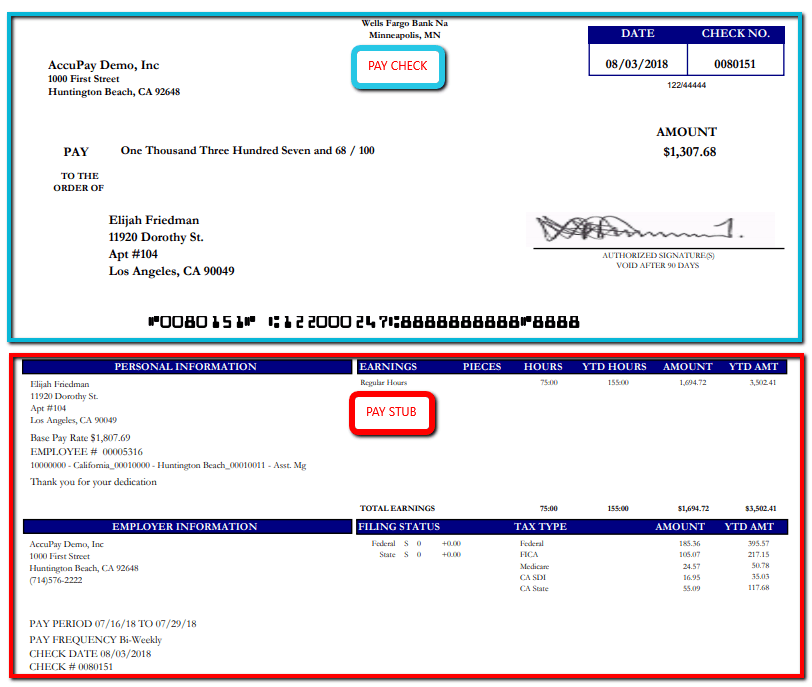

Complete a new Form W-4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer. The amount of money you actually take home after tax withholding and other deductions are taken out of your paycheck is called your net income or take-home pay. FIT is applied to taxpayers for all of their taxable income during the year.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. If you failed to adjust your W-4 appropriately and it resulted in no federal income tax withheld from your paychecks you will likely owe the IRS money when you file your income tax return. A paycheck to pay for retirement or health benefits.

Here are the step by step calculations. Allowance Claiming One allowance is equal to one tax exemption. With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from.

For your employee her taxable income is not high enough to withhold federal tax. New hires must fill out Form W-4 Employees Withholding Certificate when they start working at your business. The overtime wage should be calculated at time and a half.

The most common pre-tax contributions are for retirement accounts such as a 401 k or 403 b. The IRS designed a new W-4 form that removed withholding allowances beginning in 2020. Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

FIT on a pay stub stands for federal income tax. Deductions for each paycheck. For each pay period the gross pay is 45759.

It also means an employer must match that 62 for each employee. So if you elect to save 10 of your income in your companys 401 k plan 10 of your pay will come out of each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self-employment.

This will list any of the hours that you used during this pay period. FICA is a US. You need to submit a new W-4 to your employer giving the new amounts to be withheld.

You might face penalties and interest as well. More information is available from the Internal Revenue Service IRS at httpsappsirsgovapp. The same is true if you contribute to retirement accounts like a 401 or a medical expense account such as a health savings account.

It is deducted incrementally from each paycheck and can vary depending on the number of exemptions you chose to claim. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Near your regular pay box you may see boxes labeled with overtime holiday and sick pay.

Some are income tax withholding. As you work and pay FICA taxes you earn credits for Social Security benefits. When you were first hired by your employer you were required to fill out a W-4 form.

Federal withholding refers to the federal income tax and Social Security and Medicare taxes your employer is supposed to take out of your earnings. The fed OASDIEE 2021 tax rate is 62 with a taxable maximum of 142800 an increase from 2020 taxable maximum of 137700. To adjust your withholding is a pretty simple process.

These are contributions that you make before any taxes are withheld from your paycheck. If enough federal taxes are not withheld youll likely owe the Internal Revenue Service when you file your tax return. It stands for the.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. You can use the IRS withholding estimator which helps you to figure out if you need to give your employer a new W-4.

Pin By Soph Bee On Life Occults Money Management Advice Money Saving Strategies Money Management

How To Budget If You Are Paid Every 2 Weeks Budgeting Money Budgeting Finances Budgeting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Football Ate My Paycheck Football Gildan Heavy Blend Hoodie In 2022 Hoodies Shirts Sweatshirts

That Paycheck Was Pathetic For The Amount Of Nonsense I Tolerate Life Quotes Be Yourself Quotes Words Of Wisdom

Paycheck Budgetfinance Gift Budget Plannerbudget By Etsy Budgeting Budget Planner Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your Paycheck Credit Com

Understanding Your Paycheck Youtube

Dresses I Want To Spend My Paycheck On Dresses Clothes Design Fashion

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Fly Supply On Instagram Paycheck Fit Ochocinco X Flysupply Shop Now Flysupplyclothi En 2021 Ropa De Moda Hombre Estilos De Moda Masculina Moda Hombre

Should I Quit My Job I Quit My Job Job Career Job Interview Questions

A Guide On How To Read Your Pay Stub Accupay Systems

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

My Jp Ate My Paycheck All Over Print Lath1609214 In 2021 Print Paycheck Unisex Fit

My Favorite Exercise Is A Cross Between A Lunge And A Crunch I Call It Lunch Foodie Lunc 365 Quotes Quotes Funny Quotes

Brotherly Love In 2021 Brotherly Love Love Dedication

Steps For Financial Stability Youtube Marketing Toolkit Rank Your Youtube V Video Marketin Money Saving Strategies Money Management Advice Budgeting Money